30+ mortgage transfer after death

Generally speaking if you transfer a piece of real property subject to a mortgage to. Web Learn if you might be eligible for a mortgage transfer.

What Are The Implications Of The Death Of A Home Loan Borrower

Web Ultimately what happens to your mortgage after you pass away greatly depends on state laws and what youve set up through your Estate Plan while youre still alive.

. Those named in a TOD dont have access to the assets. Your mortgage lender still needs to be repaid and could foreclose on your home if that. In some situationssuch as a divorce or the death of a loved oneyou might want to transfer a.

Close or transition deposit accounts by sending a notarized Letter of. The loan still exists and needs to be paid off just like any other loan. Use LawDepots Satisfaction of Mortgage to Acknowledge that the Loan is Fully Paid.

For private student loans on the other hand there is no law requiring. Web Transfer on death TOD applies to certain assets that must be passed on without going through probate. Ad Answer Simple Questions To Make Your Mortgage Deed Form.

Web The death of a borrower changes things but perhaps not as much as youd think. The new owner will usually have to complete a little paperwork often by. Web If you have the death certificate you can upload it once youve completed the form.

Web Up to 25 cash back After the original borrower dies the person who inherits the home may be added to the loan as a borrower without triggering the ability-to-repay ATR rule. Web What Happens to the Mortgage when Property is Transferred to Beneficiaries at Death. Web When you pass away your mortgage doesnt suddenly disappear.

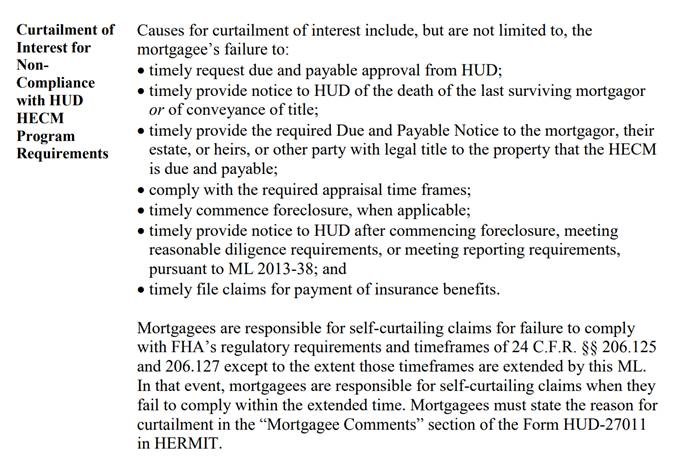

Web If the deceased person filed a transfer-on-death deed that deed will specify the new owner of the property. Web This federal law prevents banks from treating a borrowers death as a transfer in certain situations including when the borrowers surviving spouse inherits the. Web If you give someone your house via transfer on death deed it may or may not be protected from Medicaid estate recovery MERP after you die depending on the.

Notify Us Online By mail. If there is a. Web Transferring property out of a trust after the trustors death is a multistep process in which the trustee fills out deed documentation identifies mortgages and.

Co-signers on a loan. Joint owners or account holders. Therefore the lender usually ends.

Web Proof of death is required which may be an original or a certified copy of the death certificate. Answer Simple Questions To Create Your Legal Documents. Web If upon your passing no one has been designated to inherit the loan and no one pays the lender will still need to collect the debt.

Web After you die the following four parties could become responsible for your debts. Ad Get a High-Quality Fill-in-the-Blank Satisfaction of Mortgage.

Potential Cre Tax Implications For 2021 Mile High Cre

Free 34 Loan Agreement Forms In Pdf Ms Word

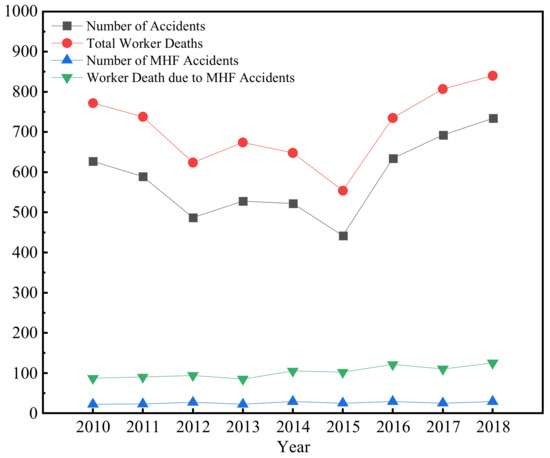

Applied Sciences Free Full Text A Mathematical Modeling Of Evaluating China S Construction Safety For Occupational Accident Analysis

My Dad Passed Away And I Ve Been Paying His Mortgage How Can I Get The Loan Put In My Name Fox Business

The Ultimate Guide To Selling An Inherited Property 2022 Homesellingexpert

Reverse Mortgage Heirs Repayment Q A Just Ask Arlo

Families In Eu 15 A Sterreichisches Institut Fa R Familienforschung

How A Transfer On Death Deed Works Smartasset

Easy Halifax Mortgages For Over 70s 4 16 Fixed 2023

What Happens To Mortgage After Death Bankrate

Vance County Schools 2022 Booklet 22 23py 1 12 22 By Pierce Group Benefits Issuu

Free 9 Sample Balloon Loan Calculator Templates In Pdf

Death Real Estate And Estate Tax Foreclosurephilippines Com

Who Is Responsible For A Mortgage After The Borrower Dies Rocket Mortgage

What Is The Correct And Legal Way To Execute A Property Sale Agreement Quora

Reverse Mortgage Heirs Repayment Q A Just Ask Arlo

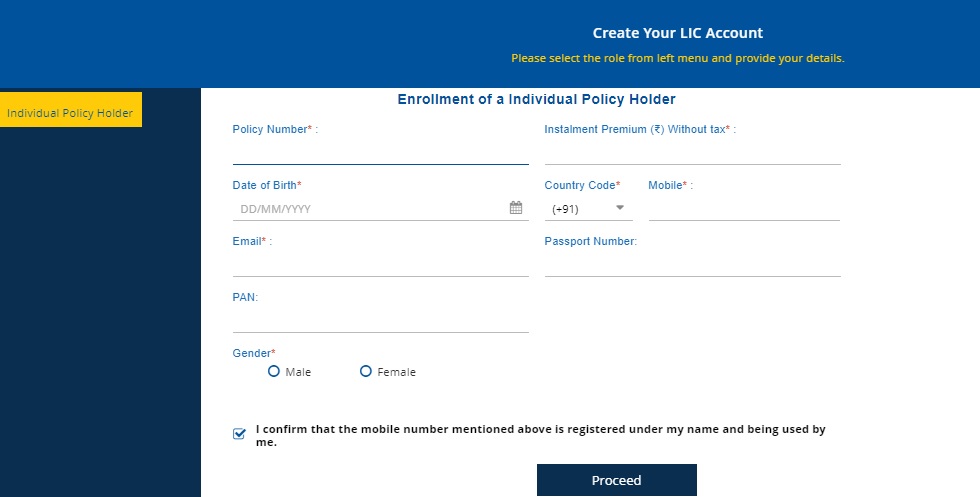

Loan Against Lic Policy Interest Rate Eligibility How To Apply